Wise and Profee are two prominent names in international money transfers that offer convenient solutions for individuals seeking to send money across borders. When remitting funds to Brazil, choosing the right service becomes essential if you are looking for the most efficient and cost-effective method.

In this editorial comparison, we explore Wise and Profee, focusing on their features, fees, exchange rates, and overall user experience specifically tailored to remittances to Brazil. By dissecting these aspects, we aim to offer clarity and guidance to those seeking the most effective way to send money to this vibrant South American nation.

Whether you're an expatriate supporting family or friends or simply need to send money for personal reasons, understanding the differences between Wise and Profee can help you make an informed decision that aligns with your needs. Join us as we evaluate these platforms to determine the optimal choice for your remittance needs to Brazil.

Brief overview: Wise & Profee

Countries

Currencies

Exchange rates

Fees

Registration and transfer process

Sending and receiving money

Safety

Results

Brief overview: Wise & Profee

What is a Wise money transfer? Wise, formerly known as TransferWise, is an international money transfer service that specialises in providing low-cost, transparent, and efficient solutions for sending money across borders. Wise also offers its banking cards, providing «convenient financial management solutions» for users. These cards empower individuals to easily access and manage their funds for everyday transactions or international payments. Founded in 2010 by Taavet Hinrikus and Kristo Käärmann, Wise has garnered widespread acclaim for its innovative approach to currency exchange and cross-border payments.

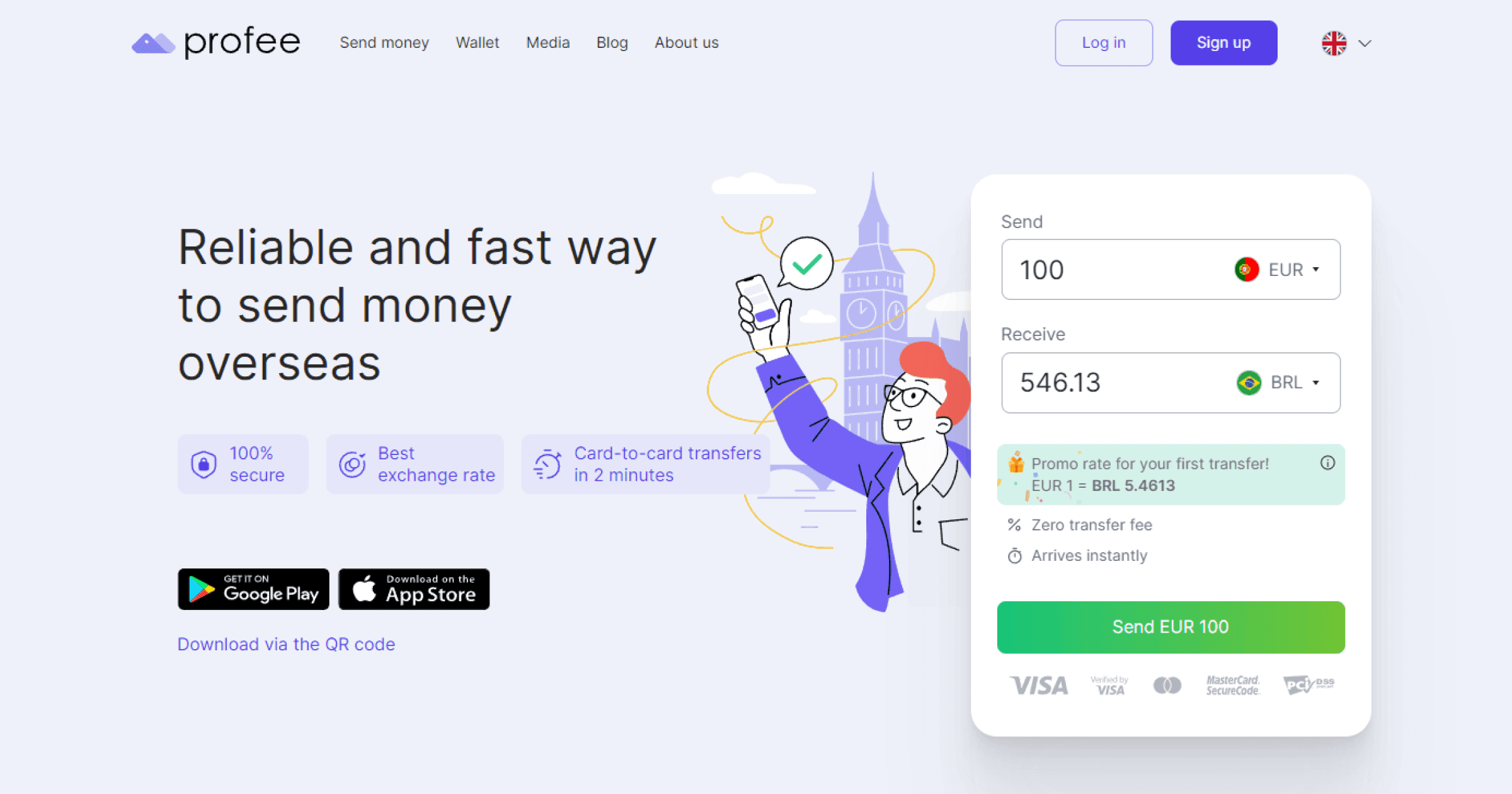

So, what is Profee? Profee emerges as a rapidly evolving platform, demonstrating its proactive approach to meeting client's needs with the recent introduction of Pix as a delivery option for transfers to Brazil. This dynamic growth underscores Profee's commitment to innovation and user-centric solutions. Across multiple countries, Profee stands out as a dependable and swift online remittance service. With diverse payment methods available, including Visa, MasterCard, Maestro, bank accounts, Google Pay, and Apple Pay, Profee money transfers ensure flexibility and ease of use for its clients. Moreover, Profee's streamlined process allows recipients to access funds seamlessly without registering. This emphasis on client convenience and efficiency solidifies Profee's position as a trusted and preferred choice for individuals seeking reliable international money transfer services.

Countries

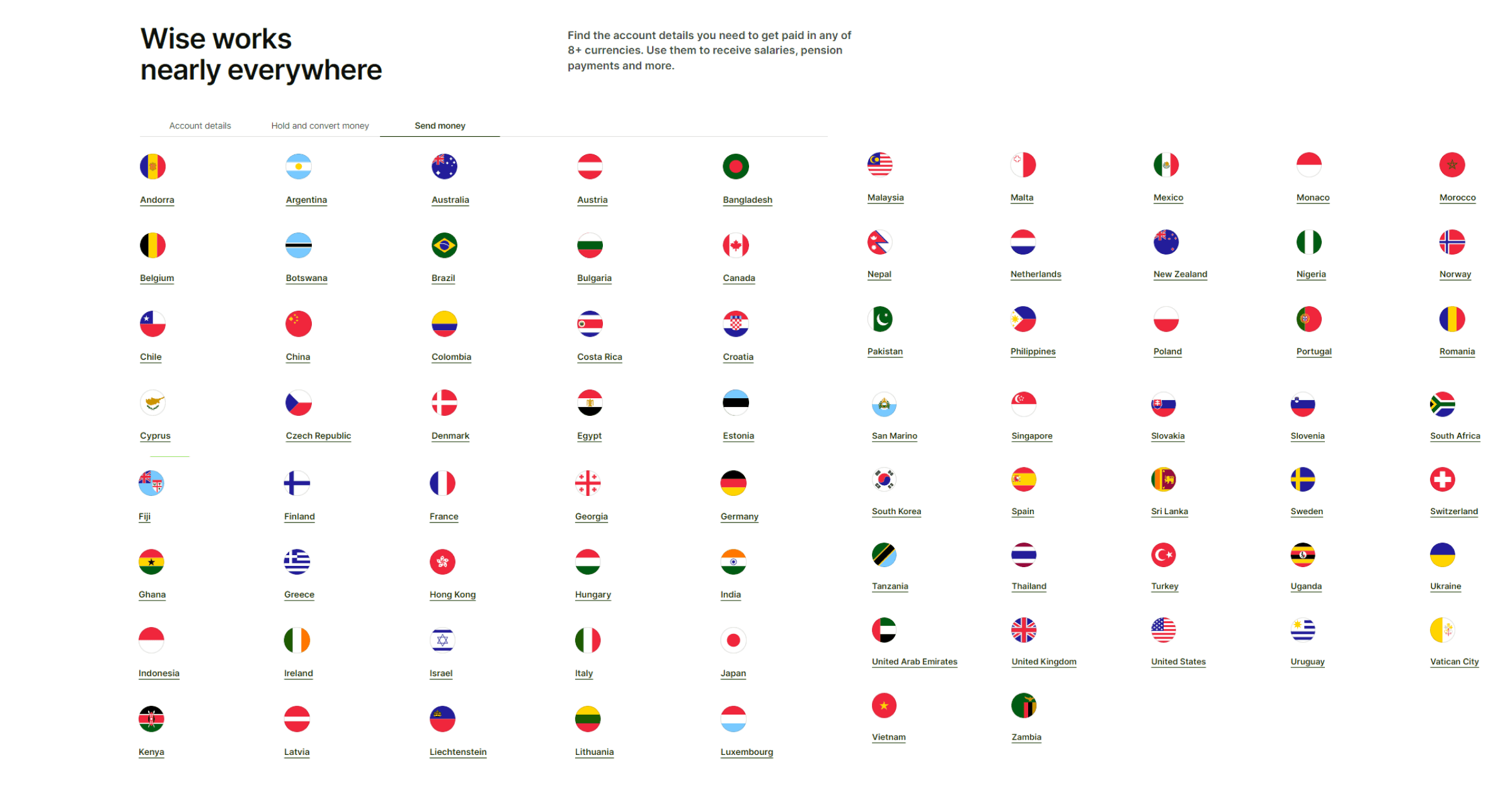

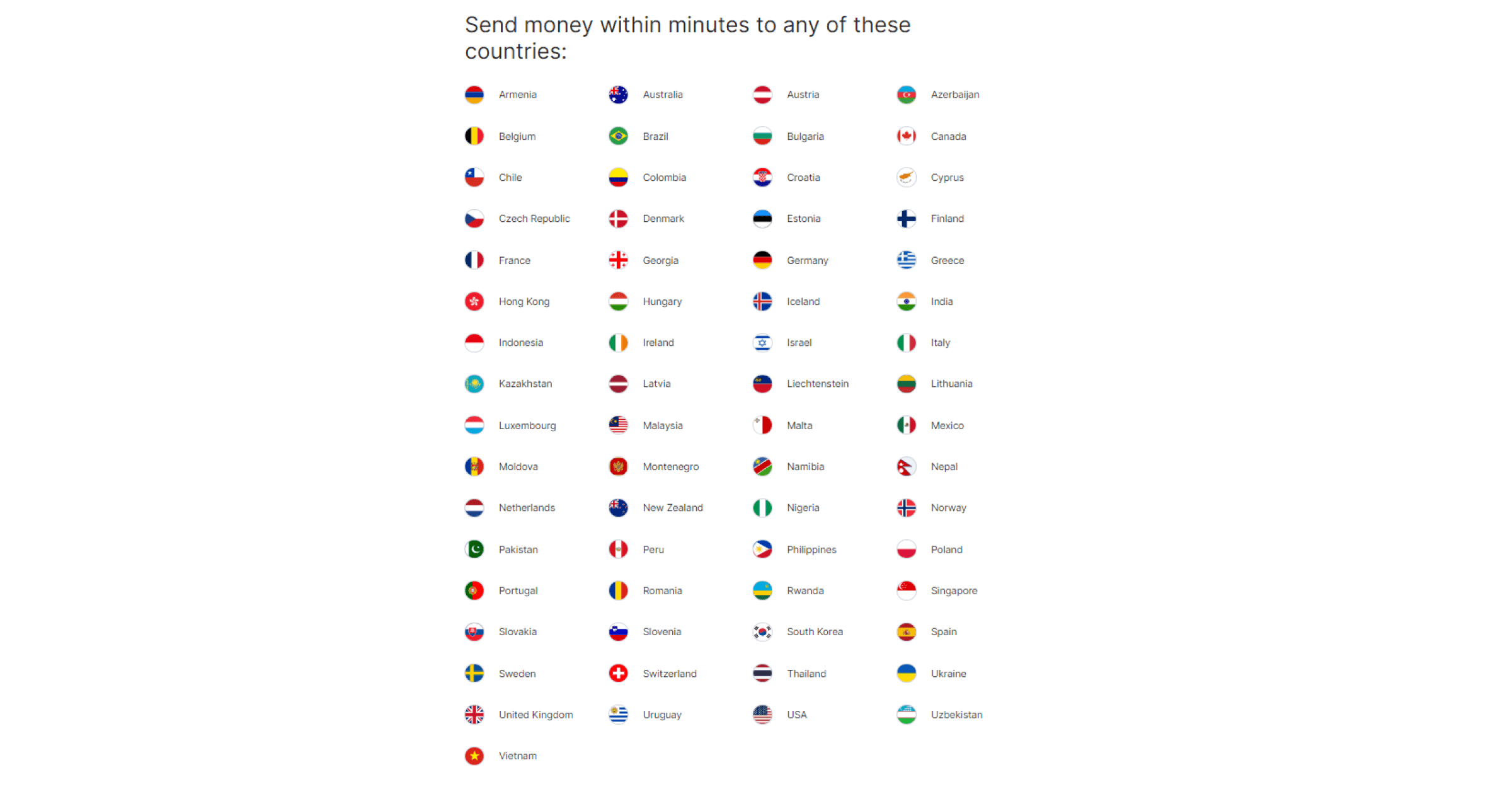

Based on the information provided on Wise's website, users have access to transfers in 62 countries directly listed. However, Wise also alludes to a broader scope of coverage, referencing details about over 70 countries or 140 countries depending on the specific page or section of the site. This suggests that our primary focus will be on the 62 listed countries.

Profee facilitates transfers to over 65 countries, including Ukraine, Nigeria, India, and Brazil. The comprehensive list of available countries is readily accessible on the Profee website, providing customers with transparency and clarity regarding their options for international transfers.

Currencies

Wise money transfer extends its services to transactions in 40 diverse currencies, providing users with a robust selection of options for their international financial needs.

Profee clients enjoy the convenience of conducting transactions in more than 45 currencies, allowing for seamless international money transfers. This breadth of currency options facilitates global connectivity and fosters closer relationships with loved ones worldwide.

Exchange rates

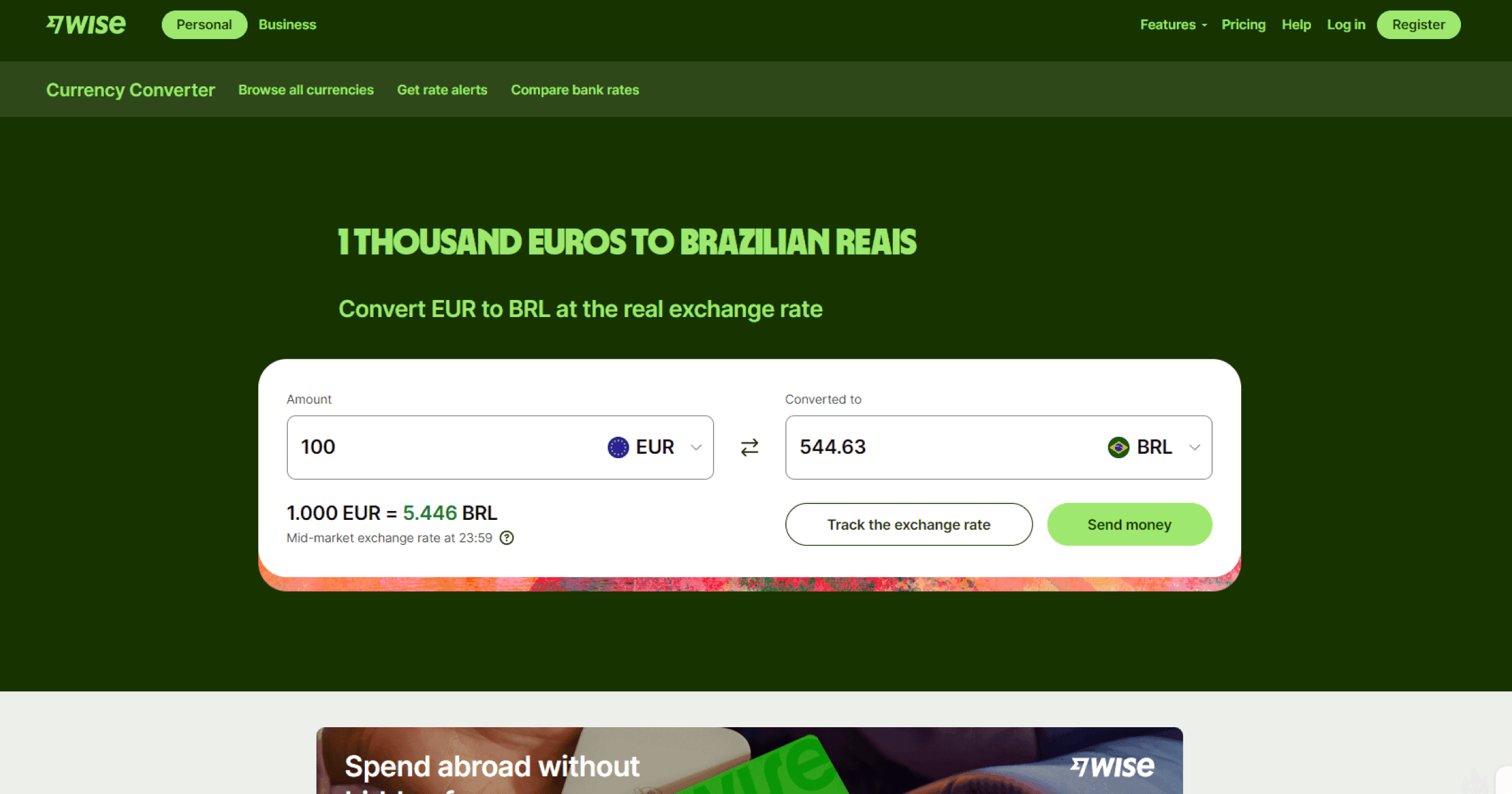

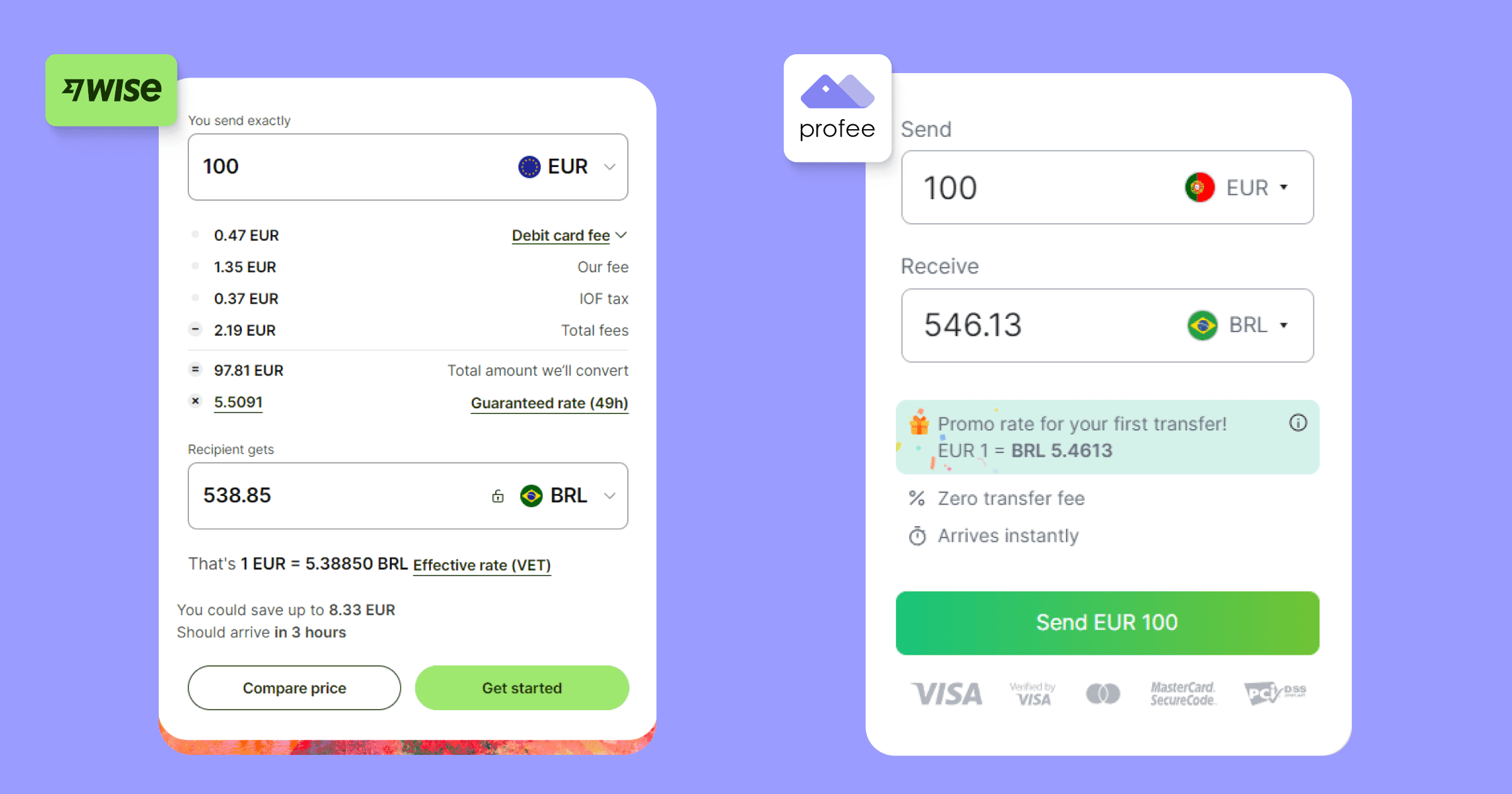

When examining the exchange rates for EUR to BRL:

Wise offers a rate of 1 EUR = 5.446 BRL. However, it's important to note that Wise applies commissions for certain transactions, which should be considered when evaluating the overall cost of transferring funds to Brazil.

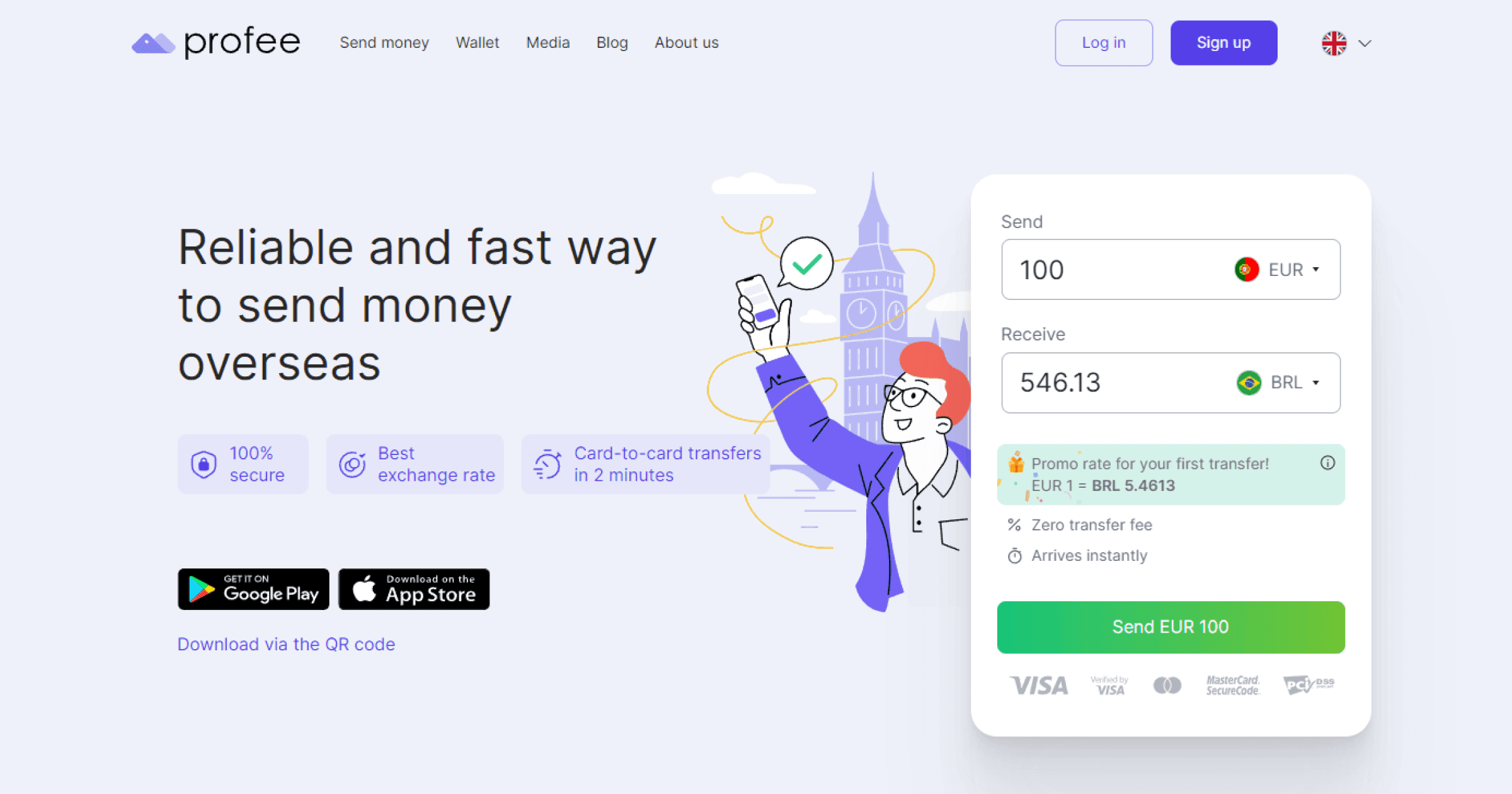

In contrast, Profee presents a rate of 1 EUR = 5.4613 BRL, with the added benefit of an initial promotional rate that enhances the cost-effectiveness of the first transfer.

Fees

Wise imposes commissions for various transactions, including debit or credit card usage, and the IOF tax and Wise money transfer commission. While Wise provides detailed information about its fee structure, it may appear intricate to those unfamiliar with it, potentially posing a challenge for users navigating the platform for the first time.

When it comes to commissions, Profee stands out by offering transfers to Brazil without any additional fees.

With Profee, clients experience a seamless process. They only need to specify the amount to send or receive, leaving the calculations to the platform. This transparent and hassle-free approach ensures clarity and ease of use for all customers.

In Profee reviews, clients write that “money transfer time and fee is much better than any existing services”.

Registration and transfer process

Imagine you're in a situation where you urgently need to send money and primarily use your phone – perhaps you're working on the go or travelling. In such circumstances, the simplicity of the registration and transfer process becomes paramount.

Wise's registration process may pose some challenges when you're relying solely on your phone. Immediate identity verification is required, which entails submitting photos of your government-issued ID and possibly including a photo of yourself holding the ID for facial verification. This process, especially the requirement of taking photos, could be physically inconvenient or cumbersome when you're on the move or engaged in other activities.

People note that "the interface is not intuitive in Wise money transfer reviews. It needs to be simplified.

With Profee, you can seamlessly complete the entire process using your phone. You start by registering with your phone number, a quick and convenient step that doesn't require any additional documentation. Then, before your first transfer, you'll be prompted to enter some basic personal details such as your name, surname, date of birth, country, and address. This process can be completed swiftly, whether on your lunch break at work, catching a film in the evening, riding the bus, or chatting with your mum over Zoom. Once these details are entered, you can initiate your transfer immediately.

In Profee money transfers, clients can access three levels of free accounts. They can easily verify their identity and increase their transaction limits at any time through the platform's user-friendly bot interface. This streamlined process ensures that customers can quickly and conveniently enhance their account capabilities to better suit their financial needs.

Profee reviews show a simple, easy-to-use interface in pleasant colours. You can easily figure out how to use the app and the web version.

In this scenario, Profee's streamlined registration process proves to be more user-friendly and convenient. It allows you to quickly and effortlessly send money, even when you're on the go and rely solely on your phone.

Sending and receiving money

Profee stands out for its diverse range of options, ensuring convenient and flexible transactions for clients. Leveraging the widely-used Pix system, sending money to Brazil becomes a seamless process. Moreover, Profee supports modern digital payment solutions like Google Pay and Apple Pay alongside traditional methods such as SOFORT, BLIK, bank cards, and bank accounts. Additionally, Profee accommodates customers by enabling access to select local payment systems, further enhancing accessibility across different regions.

Similarly, Wise money transfer offers a robust selection of methods for sending money to various countries, providing users with many options tailored to their specific needs and preferences.

In Wise money transfer reviews, users say there are some difficulties in confirming transfers and information. Some users don't get their money, or it takes too long, but we think Wise services is trying its best to solve these problems or offer alternatives.

Although Wise advertises the availability of Pix, there have been reports of users experiencing issues with its functionality.

Results

| Aspect | Profee | Wise |

|---|---|---|

| Countries | Facilitates transfers to over 65 countries | Offers transfers to over 62 countries, with potential for more |

| Currencies | Supports transactions in more than 45 currencies | Transactions available in 40 diverse currencies |

| Exchange Rates | EUR to BRL rate: 1 EUR = 5.4613 BRL, promotional rate for your first transfer | EUR to BRL rate: 1 EUR = 5.4463 BRL |

| Fees | No additional fees for transfers to Brazil | Commissions applied for various transactions |

| Registration Process | Simple and quick, register with phone number, minimal documentation required | Immediate identity verification may be cumbersome on mobile |

| Sending and Receiving | Offers diverse options, including Pix, digital payment solutions, bank cards, and local payment systems | Multiple methods are available for sending money globally |

Profee money transfer is the preferred choice for sending money to Brazil due to its wider reach, favourable exchange rates, and fee-free transfers. With over 65 countries available for transfers and support for more than 45 currencies, Profee offers greater flexibility and convenience. Its exchange rate of 1 EUR = 5.4613 BRL surpasses Wise's rate, potentially saving customers' money. Profee's fee-free transfers to Brazil make it a more cost-effective option. Profee provides a consistent and profitable solution for international money transfers to Brazil.

So now you know what a Wise money transfer and a Profee are. Choose the best for yourself!