Once in Japan, it’s impossible to avoid crazy shopping. Every tourist falls for this and returns home with an extra suitcase or two. We can’t judge – been there, done that! But you know what? As a foreigner, you can buy things cheaper than they are. Sharing how in this guide on Japan’s tax-free shopping.

VAT in Japan

Who can get the VAT refund in Japan + documents

Tax-free shopping rules in Japan

How to claim a tax refund in Japanese airports

Tax-free QR code

How tax-free shopping in Japan works in the store

Tips on shopping in Japan

FAQ – Japan tax-free shopping guide

VAT in Japan

VAT (Value Added Tax) is applied to almost all goods and services. Eating out, buying groceries, renewing your wardrobe, or getting household appliances – the final price will include this consumption tax.

In Japan, the standard VAT rate is 10%, while a reduced one of 8% is applied to food, non-alcoholic beverages and some other essential products.

Japanese shops are very clear about their charges, as most tags display two types of prices: one with and one without VAT. If your product turns out to be more expensive than you thought, you probably looked at the wrong number.

Fortunately, some people may enjoy the benefits of the VAT refund in Japan. Let’s check whether you’re eligible.

Who can get the VAT refund in Japan + documents

Tax-free shopping in Japan is provided for 10 categories of visitors. Below, you can find the full list of them, along with the documents requested for the VAT refund in Japan.

| Eligibility | Documents needed for Japan’s VAT refund process |

|---|---|

| Short-term stay visitors (foreigners) | Passport |

| Diplomats | Passport |

| Officials | Passport |

| Individuals with the stamp of SOFA | Passport |

| Landing at a port of call | Passport |

| Transit | Passport |

| Cruise ship tourists | Landing permit for cruise ship tourists |

| Crew members | Crew members landing permit |

| Emergency landing | Permission for emergency landing |

| Distress | Landing permission due to distress |

In each case, Japan’s VAT refund process will start only if you’ve entered and will leave the country within six months. Shop assistants must verify your arrival and departure days by checking your passport (the one with a valid visa!).

Tax-free shopping rules in Japan

Starting from November 1st, 2026, the tax-free shopping rules in Japan will change. We’ll divide this part of the article into two pieces:

- Current regulations for those who have a trip soon.

- Future regulations, so you know what to expect.

Tax-free shopping in Japan now

- How much the VAT refund is in Japan

8% or 10% depending on the product.

- Two product categories

Products are divided into General Items and Consumable Items.

- General items: household appliances, clothes, jewellery, watches, shoes, artefacts, bags.

- Consumable items: food, beverages, medicines, cosmetics.

- Minimal amount

- At least 5,000 JPY for general items.

- Between 5,000 and 500,000 JPY for consumable items.

Categories are calculated separately. For example, if you bought a t-shirt for 2,500 JRY and a facial cream for 3,500 JRY, you won’t get 10% back. Plus, the purchases must be made in the same store on the same day. That’s how tax-free shopping in Japan currently works.

- Packaging

All consumable items are packed in a special bag. You cannot open it and use your purchases until you leave the country.

General items are mostly free to use, but if you receive them in a special bag, keep them packed until departure.

Special bags look similar to this one:

All the tips on how to claim a tax refund in Japan will be useless if you don’t store the products correctly.

- International parcels

If you plan to send tax-free items back home via any means, you cannot get the VAT refund in Japan. If you have too much luggage, sending pieces that you owned before the trip would be wiser. Or just accept the reality and lose 10% of the refund.

- Keeping receipts

Don’t throw away receipts on tax-free products, as you may be asked to present them at the point of departure. If you can’t show them, you’ll need to repay the 10% tax.

Upcoming changes in Japanese tax-free shopping rules

Starting from November 1st, 2026, tourists will pay full price at stores. Refunds will be possible only at the point of departure, provided all receipts are presented. We can already imagine the never-ending queues at airports, but let’s hope Japan will manage it smoothly.

What else will change regarding the tax-free shopping in Japan?

- Removal of the minimum 5,000 JRY and maximum 500,000 JRY limits.

- Refusal of the special packaging.

- Product categories will be merged.

How to claim a tax refund in Japanese airports

Currently, VAT is only deducted in stores or refund counters of special providers when you use their services. As for the future, the procedure of how to claim a tax refund in Japanese airports is yet to be revealed.

Inspection

When leaving Japan, you must undergo a tax-free inspection. Proceed to the Customs counter with your passport and the purchased goods for a quick inspection. Counters may be located before or after security, depending on the airport

Tax-free QR code

One of the ways of how to claim a tax refund in Japan is by generating a special QR code.

- Go to Visit Japan Web service and fill in the required data.

- Get your personal QR code.

- Show it to the shop assistants instead of a passport.

However, not every store accepts QR codes, so you have to always carry your physical passport with you.

More for travellers:

How tax-free shopping in Japan works in the store

Now let’s imagine we’re already in Japan, ready to buy the fanciest clothes:

- Look for the ‘Japan Tax-Free Shop’ logo.

- Tell the cashier you want tax-free.

- Show your passport (no copies or photos allowed).

- Staff checks your eligibility and the minimum amount.

- For consumables, they pack items in a sealed bag and attach a tax-free record.

- You pay the price without VAT (minus handling fee if applicable).

Getting a VAT refund in Japan is very easy; the most challenging part is resisting the urge to buy everything you see!

Tips on shopping in Japan

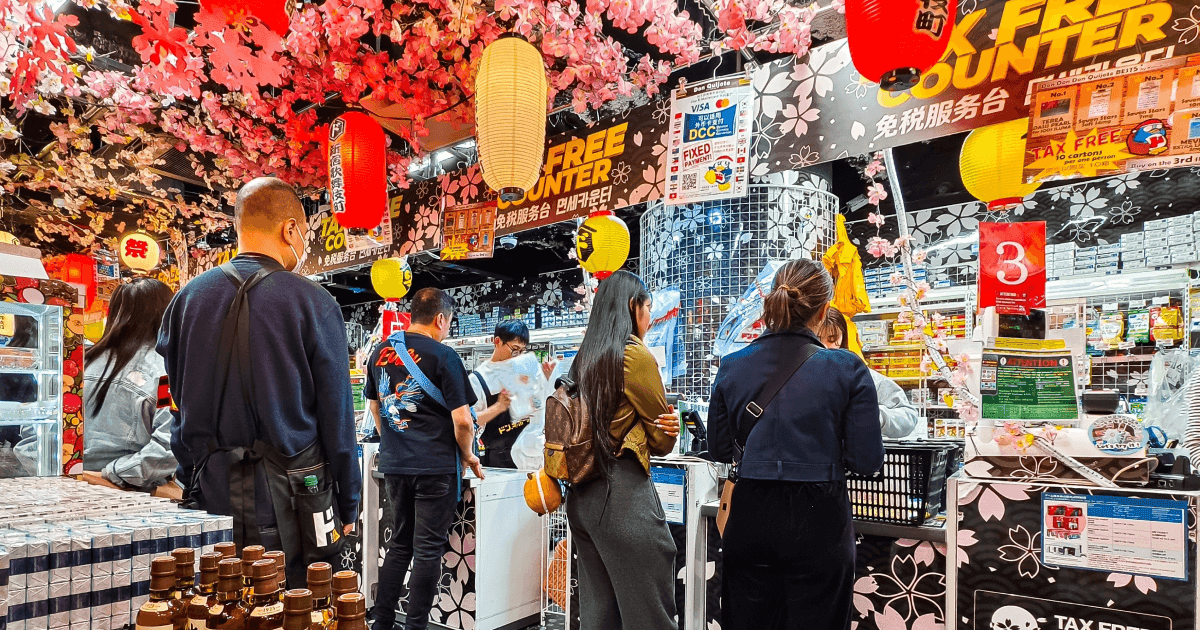

Compare prices

In Japan, prices vary widely from store to store. For example, drugstores such as Matsumoto Kiyoshi, Don Quijote, or Sugi Drug often run promotions and offer tax-free skin care products and medicine at affordable prices. Don’t rush into buying the first thing you see. Most likely, there are places where you can find the same item for a lower price. The immaculate knowledge source on this topic is TikTok, no joke! Thousands of people shared their reviews and recommendations in Japan – take a look.

Carry cash

You can pay with foreign cards in many places, but Japan still heavily relies on cash. Outside Tokyo, most shops and local cafes won’t accept your card and will gently ask you to pay with cash. If you run out of money, don’t worry, as the ATM network is vast. Fun fact: Machines are even located in convenience stores like 7-Eleven, FamilyMart, and Lawson.

Know where to shop

Japan offers shopping options for every taste:

- Fashion: Shibuya, Harajuku, Ginza

- Traditional crafts: Asakusa (Tokyo), Gion (Kyoto)

- Souvenirs: Don Quijote, LOFT, Tokyu Hands

- Snacks & food gifts: supermarkets and konbini stores

Have a separate bag for trash

Trash bins are hard to find in Japan. So, if you don’t want to dirty your brand-new clothes or gifts, always carry a small bag for trash with you. It’s not exactly shopping advice, but it will save you plenty of time, energy, and mental stability.

Bring a reusable bag

Another useful bag! Most stores charge for plastic bags. Bringing a foldable eco-bag saves money, reduces waste, and is widely encouraged in Japan.

That’s the end of our Japan tax-free shopping guide. Save and enjoy your holidays!

FAQ – Japan tax-free shopping guide

What is tax-free shopping in Japan?

Tax-free shopping in Japan is an initiative, thanks to which certain types of visitors can buy products without VAT.

How does tax-free shopping work in Japan?

Foreigners get a deduction on certain products if they present a valid Visit Japan QR code or passport.

How much is the VAT refund in Japan?

8-10%.

Are there any fees?

Some tax-free counters may charge fees for their services. However, if you get a refund in a store, there are usually no extra expenses.

What qualifies for a VAT refund in Japan?

Most general and consumable items are a part of the tax-free shopping in Japan. You can always clarify with shop assistants.