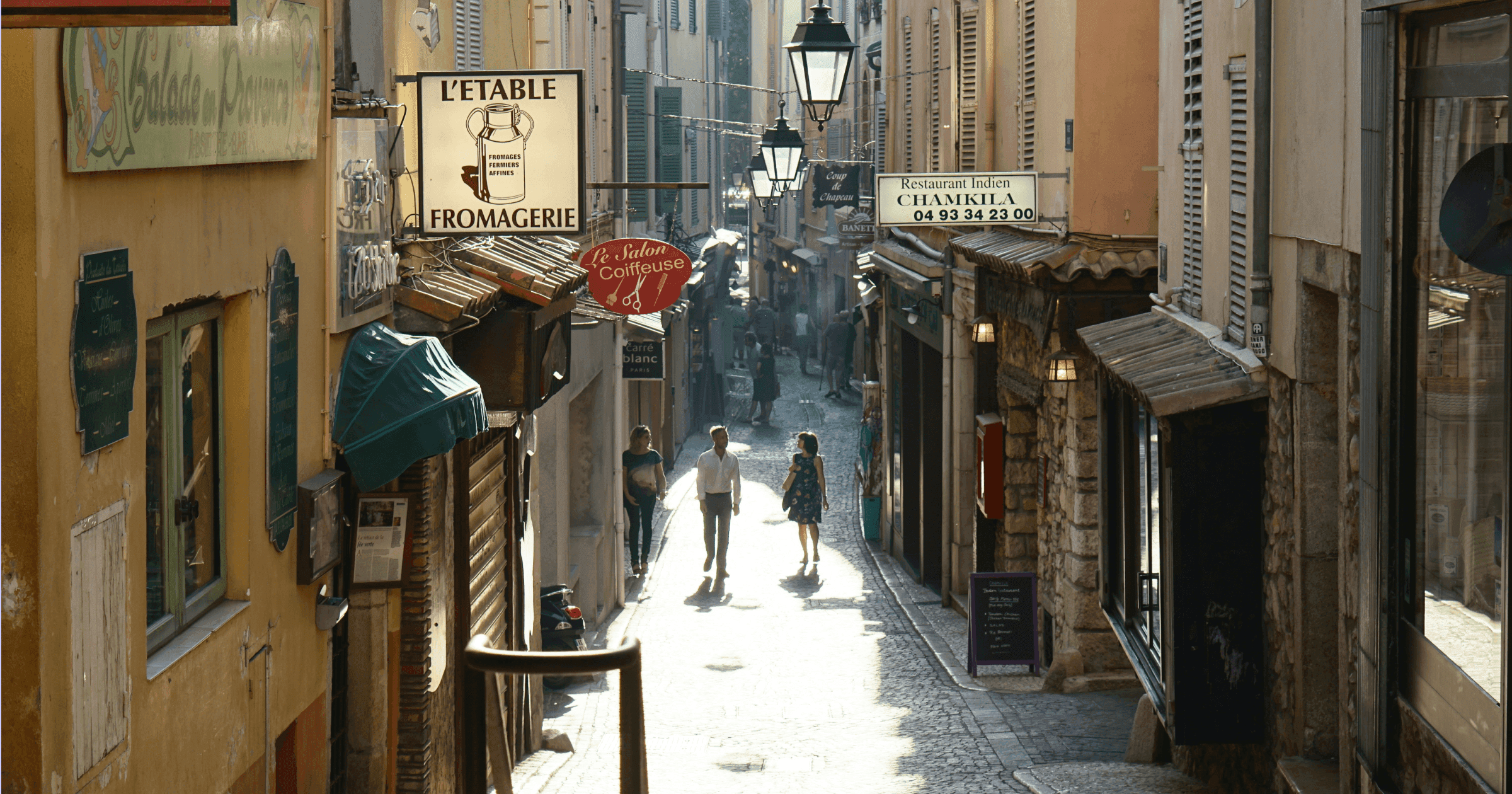

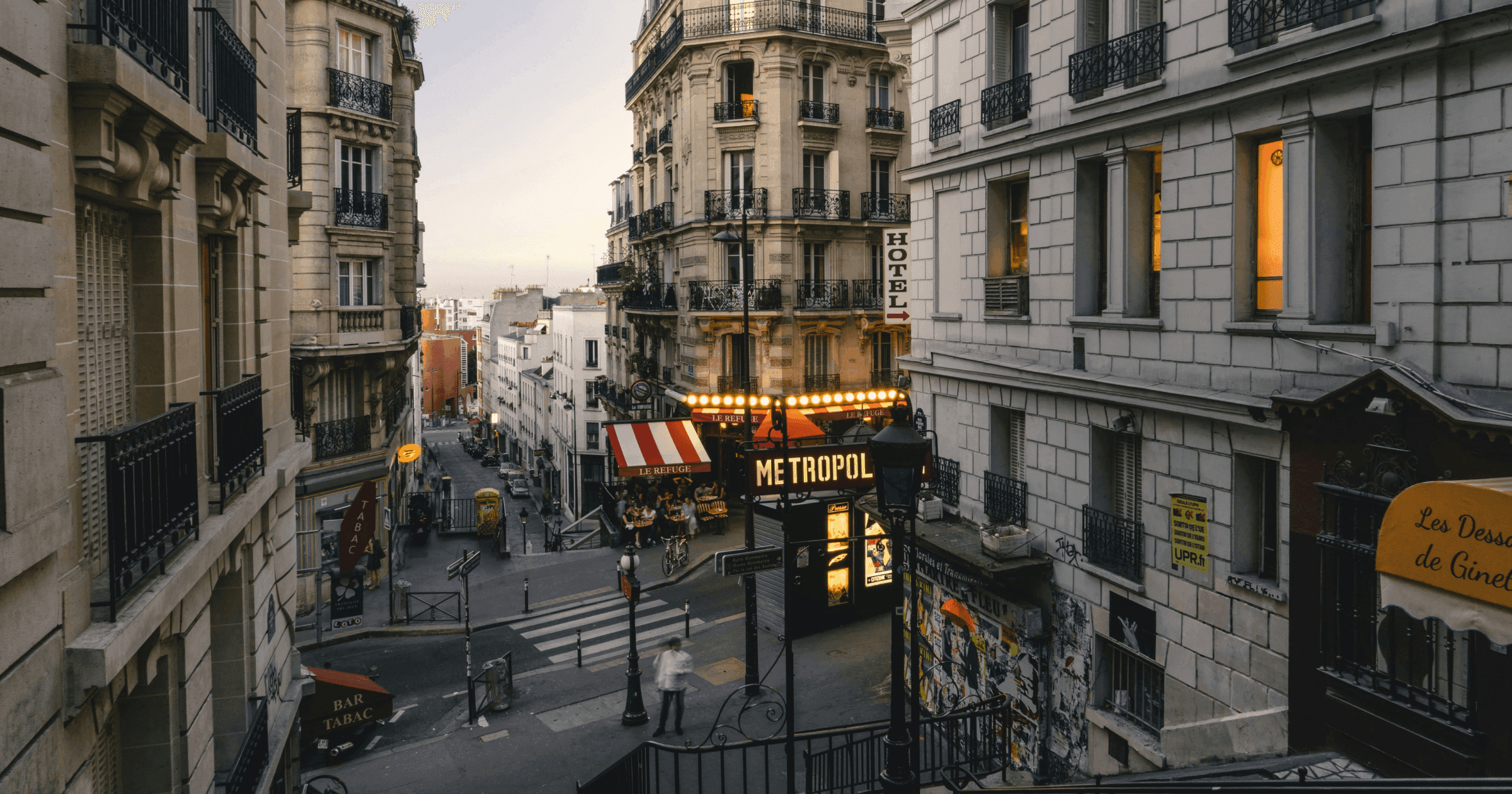

France is renowned for its rich history, cultural diversity, art, fashion, and cuisine. The country is home to a large international community—the national statistics agency INSEE claims that one in 10 people in France was “born a foreigner in a foreign country”. France actively participates in global dialogues and initiatives, promoting peace, cultural understanding, and humanitarian efforts.

According to the data provided by the Ministry of External Affairs of India, 109,000 Indians—both Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs)—are currently residing in France. The number is only expected to grow with Emmanuel Macron’s recent announcement. France aims to welcome 30,000 Indian students to its universities by 2030.

Indian communities worldwide are known to be tight-knit and deeply connected to their culture. Family is considered the cornerstone of Indian society. Hence, many Indians residing abroad tend to support their loved ones back home via money transfers. With the growing number of Indians choosing France as their second home, the question of how to transfer money from France to India is becoming more and more relevant. In today’s article, we’ll cover the most common ways to send money and analyse the pros and cons of each method. Stay tuned to learn about the best way to transfer money from France to India and how to send money from France to India commission-free. Let’s get started.

Are you moving to Europe? Check out what apps you might find helpful as an Indian.

France to India money transfer methods. Pros and cons

What’s the best way to transfer money from France to India?

Why you should send money to India from France using Profee

How to transfer money from France to India via Profee

France to India money transfer methods. Pros and cons

Bank transfers

A bank transfer may be a go-to option when sending money to India. While this method has many advantages, it’s critical to consider the negative sides.

| Pros | Cons |

|---|---|

| Bank transfers are generally recognised as a secure and safe method of financial transactions. Reputable banks have strict security protocols in place to ensure the protection of your funds. | One notable downside is associated with fees. Banks frequently impose charges for international transfers, including costs for wire transfers and currency conversion. |

| Bank transfers enjoy widespread acceptance in India, as the majority of individuals and businesses maintain bank accounts. | In addition to upfront fees, banks may impose hidden charges, potentially diminishing the amount received by your recipient. Hidden costs are also largely typical when you send money to India from France. |

| Bank transfers are reliable, allowing you to track your transactions. | Becoming a bank customer can lead to frustration due to extensive documentation and verification requirements. |

Sending money to India via cash transfer services

As convenient as it may seem, there are some aspects to cash transfer services you may not know about:

| Pros | Cons |

|---|---|

| Cash service is a fast way to transfer money from France to India. Funds are typically available for pickup on the same day. | Fees on cash transfers are usually high, and both the sender and the recipient may get charged. |

| This method is available for everyone, even if the sender and the recipient don’t have a bank account. | French money to Indian money exchange rates offered at such services often turn out to be unfavourable, making you lose money. |

| You can choose from a vast network of locations. | Sending limits at cash pickups are pretty low compared to other alternatives. |

Here’s what to expect when you transfer money to India via crypto

Surrounded by controversy, crypto transfers are becoming more popular and may offer significant advantages. Nevertheless, it is worth keeping in mind the downsides:

| Pros | Cons |

|---|---|

| Crypto allows for borderless transactions. | Learning how to send money from France to India takes time and background knowledge, which is not accessible to everyone. |

| One of the most significant advantages is that when you transfer money from France to India via crypto, the funds arrive almost instantly. | Crypto transfers are not subject to regulations, meaning they involve higher risks for your data and funds. |

| Fees on crypto transfers tend to be pretty low. | Price volatility is another major disadvantage. You can experience significant fluctuations in a span of a day, meaning French money to Indian money rates can be highly unpredictable. |

What’s the best way to transfer money from France to India?

The three methods we have discussed have their pros and cons regarding speed, costs, security, and other aspects. Although they might work for you, there is another option you should consider. With an online money transfer company, you can send money to India from France without worrying about safety while enjoying transparent transactions.

There are many providers to choose from. However, we would like to focus on the one that stands out in today’s market. And that is Profee, a European money transfer company offering a fast, secure, and affordable way of sending money to India. But don’t just take our word for it—read our in-depth comparison of the best ways to send money to India.

Why you should send money to India from France using Profee

1. Competitive currency exchange rates

When remitting overseas, paying attention to exchange rates is essential. We developed an intelligent monitoring system that allows sending funds at the best French money to Indian money rate. As of February 2024, you can make your first transfer to India at a promo rate. That means you could get the most value for your France to India money transfer and save money while supporting your family back home.

2. Security

Profee is an EMI-licensed European company adhering to regulations. We get certified according to PCI DSS security standards every year. We also implement various protection tools so you can transfer money to India without worrying about fraud and data leaks. The maximum resilience is backed up by Tier 4 data centres.

3. Affordability and no hidden costs

Curious how to send money from France to India without breaking the bank? The answer is simple—use Profee. We don’t charge fees on your first transfer and offer the best exchange rates out there.

Unlike an average bank, Profee doesn’t charge hidden commissions. We stand by our commitment to transparency. Using the online calculator, you can see how much your recipient will get in INR and the fees you will pay. Say goodbye to unpleasant surprises.

4. Minimum bureaucracy

You don’t have to go through excessive paperwork when creating an account. We only require essential information to ensure a high level of security. The registration process is done entirely online—no need to leave your house and spend time in queues. Simply verify your phone number, then enter your full name, date of birth, address, and country of residence. It takes less than 10 minutes to sign up and start supporting your loved ones back home.

5. Global coverage

Send remittances to over 60 countries worldwide, including Nepal, Singapore, Malaysia, and many more. We are constantly working on expanding our list of destination countries. Stay tuned to unlock new opportunities. In the next chapter, learn how to send money from France to India and other countries.

6. User-friendliness

Even as an inexperienced technology user, navigating the Profee app and website will be a breeze. You can see the terms of your remittance without registering by entering the transfer amount and destination country. And if you have any questions, our customer support is always there to help, working in several time zones and speaking several languages.

How to transfer money from France to India via Profee

In order to use the company’s services, you need to have a French bank account. If you’re new to France and haven’t gotten a bank card, read our latest article about opening a bank account in France as a foreigner.

Even if you already have a French bank account, it is still worth learning how to transfer money from France to India using Profee. The company’s mission to provide a favourable alternative to wire transfers makes our services more cost-effective and convenient. Making a remittance with us is easy:

Select your destination country (India), enter the amount you’d like to send;

Check the EUR to INR exchange rate;

Complete a quick registration procedure that takes less than 10 minutes;

Enter the transfer details, such as your recipient’s bank account number;

Choose a payment method and confirm the transaction.

As simple as that! No more wondering how to transfer money from France to India. Send money to NRO and Domestic accounts in India with a few taps on your device.

We hope you found this article helpful, and the question of how to transfer money from France to India is now out of the way. Download the Profee app or visit the website to send your first remittance and support your loved ones, wherever they are. Experience low fees, competitive exchange rates, fast delivery, and other perks, and stay connected via Profee.