Many Indians come to Europe annually. They seek opportunities to boost the career, or to change it completely. Obviously, moving to a new country means earning money there – and there are so many questions about spending it the right way.

How to rent a flat in the new city? How to open an account in a European bank? How to send money to India? These are just a few questions the expats are thinking over when settling in Europe. Eventually, everyone finds their own best way to send money to India, but we hope that this article will facilitate the process for you.

How to send money to India in 2024

Most common options for money transfers from Europe to India include:

Bank transfers,

Cryptocurrency,

Online services.

The latter are becoming more popular, offering favourable terms and urging to install apps that will help you send money to India.

How to choose the best money transfer option to India?

If you google ‘how to transfer money to India’, you will find plenty of ‘complete guides’, ‘extensive lists’ of money transfer apps, and so on. Understandably, many people are lured by offers promising the fastest transfers or best exchange rates – but can these promises be trusted? And is choosing the quickest or cheapest solution really enough?

Here is what we advise you to consider when choosing the best way to send money to India:

Pricing;

Exchange rate;

Security;

Speed;

Customer-friendliness.

At Profee, we aspire to provide top-notch money transfers taking into consideration all the concerns you could possibly have. Since we try to be objective and to help you choose the online service or mobile app that is best for you, we will describe the terms of some popular money services.

Pricing

Money transfer services often charge fees. It is quite understandable that powering a complex infrastructure needed to keep a transfer service running requires certain resources. Yet, paying a high commissions is unpleasant and sometimes even hard – as the transfer terms in some services are not transparent enough.

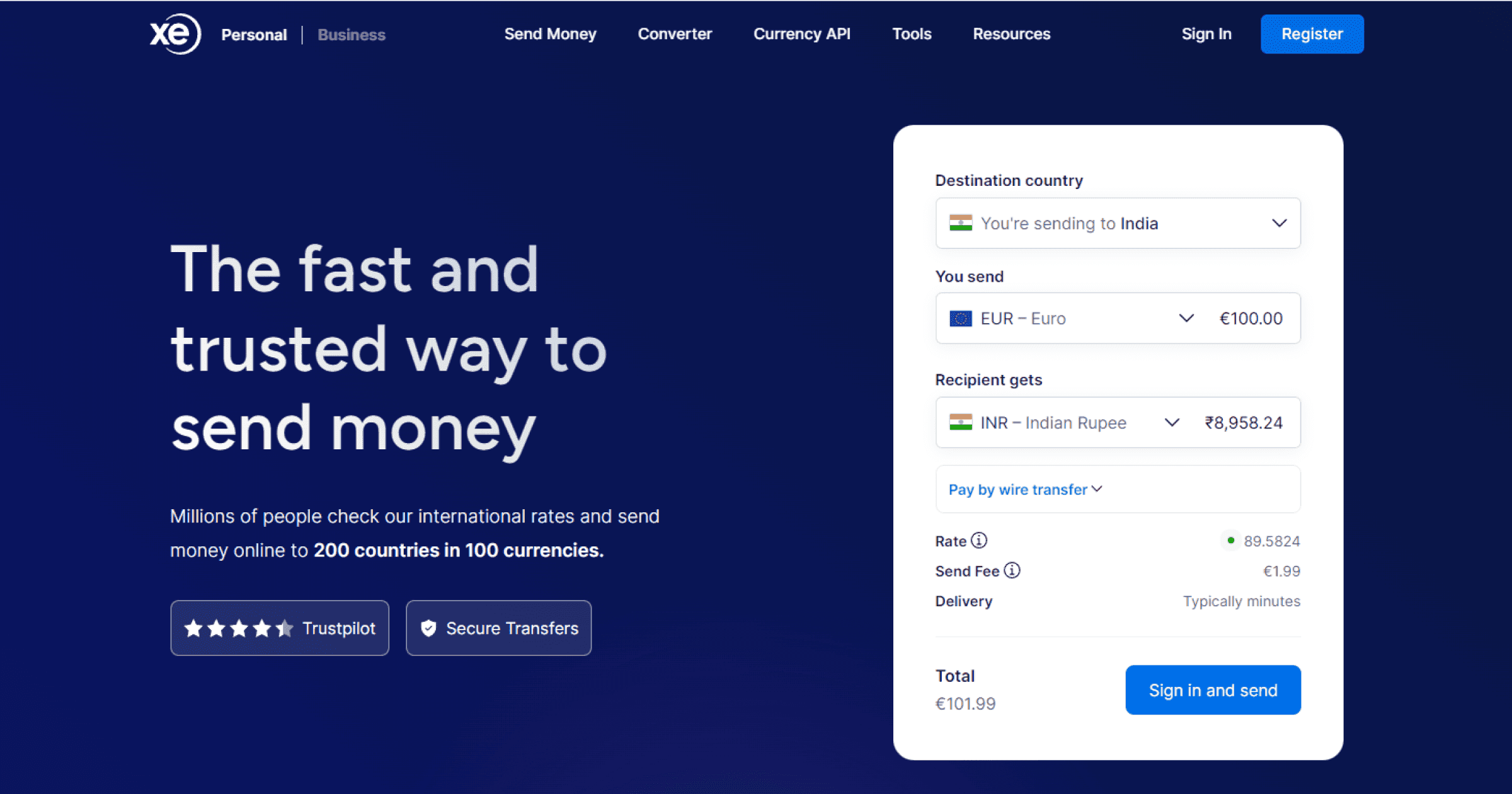

You may find the terms for well-known (and relatively cheap) money transfers to India options in the table below:

| Service | Fee (for the first100 EUR transfer) |

|---|---|

| Profee | 0 |

| Revolut | 0.35 EUR |

| Western Union | may vary |

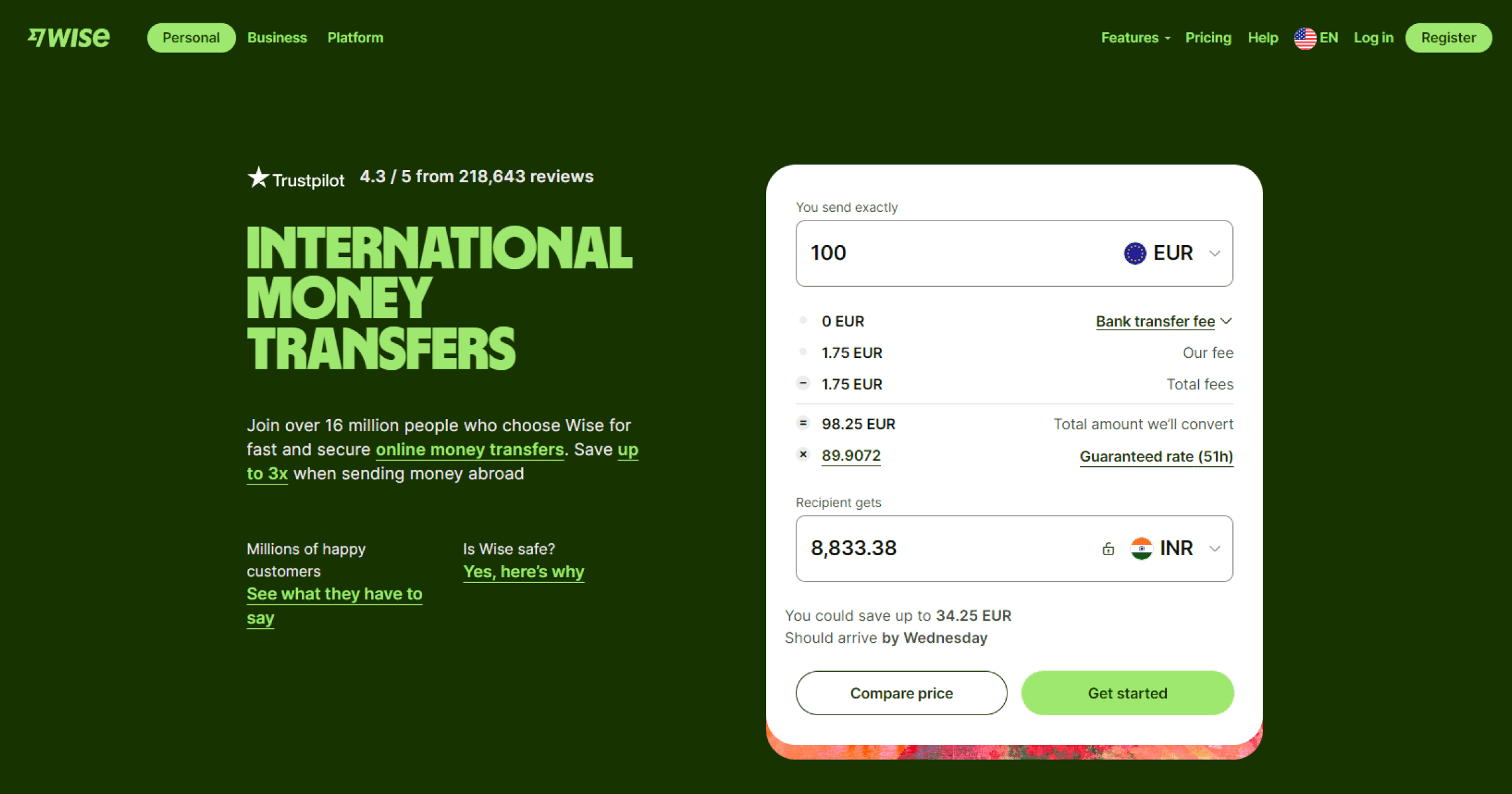

| Wise | 1.65 EUR |

| World Remit | 1.99 EUR |

| Xe | 1.99 EUR |

Please, note that the terms apply for late July 2023.

As you may see, most of the above services charge fees for transfers to India. These fees may change depending on the transfer sum or other conditions. Many expats in Europe are looking for cheap money transfers to India – as managing the budget is especially important when living abroad.

If you are remitting with Profee for the first time, the service charges no fees for sending money to bank accounts in India – regardless of the sum you want to transfer abroad.

Exchange rate

Here, the maths is simple: if an online service or a mobile app provides a more beneficial currency exchange rate, you can send more rupees to India – to your loved ones or to your own savings account in an Indian bank.

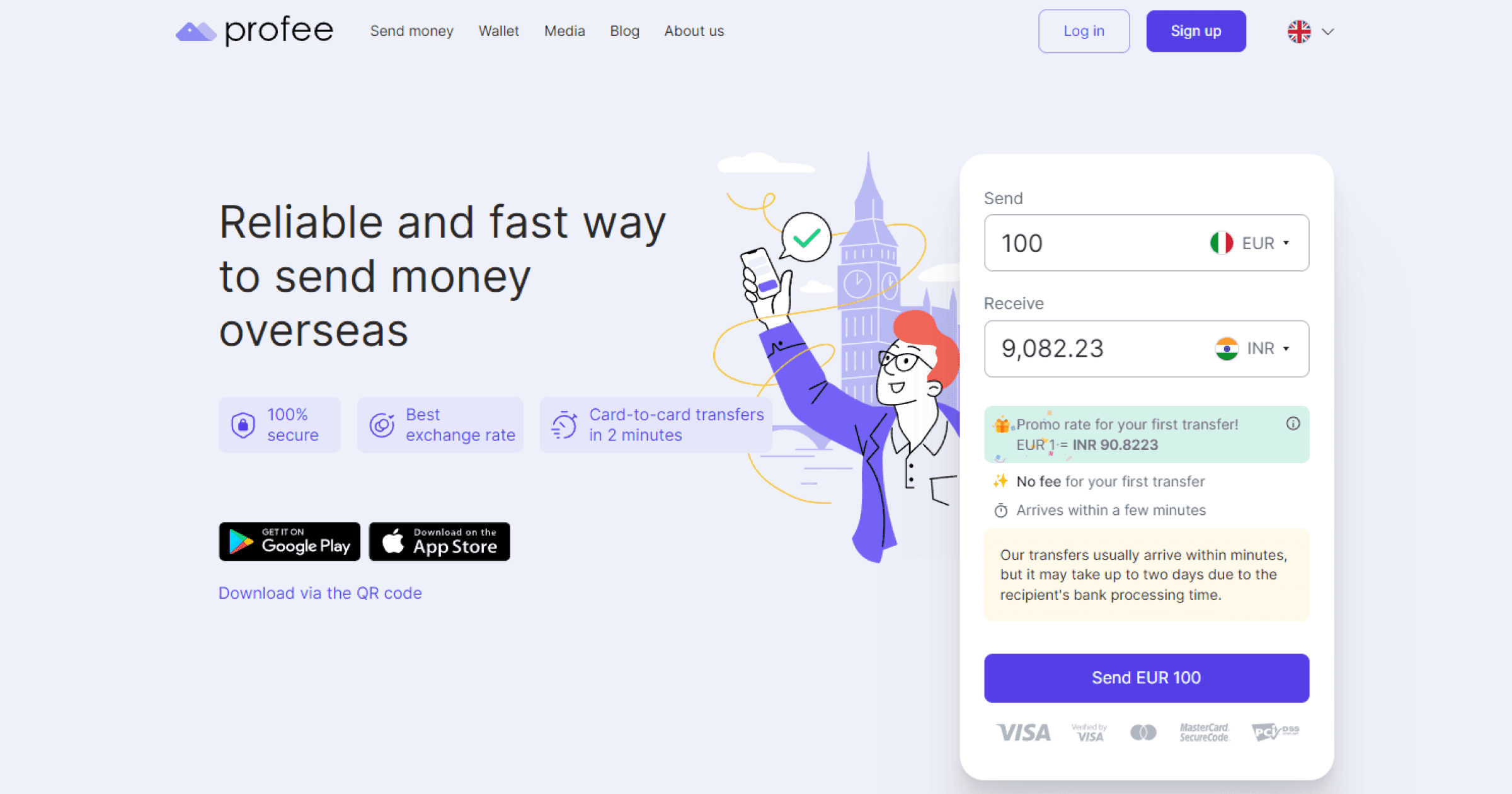

Some services offer special terms for your first transfer – therefore, let us compare the exchange rates for sending money to India for the first time. See the table below to find which rates are best to send money to India.

| Service | Exchange rate (per 100 EUR) |

|---|---|

| Profee | 9,082,23 |

| Revolut | 8,960.61 |

| Western Union | 8,955.17 |

| Wise | 8,990.72 |

| World Remit | 8,954.00 |

| Xe | 8,958.24 |

Please, note that the terms apply for the 1st transfer to India, for late July 2023.

As you may see, at Profee we offer a favourable currency exchange rate which stands out among those of the competitors. We offer a promo rate for sending money to India for the first time after creating an account with us – and we assure you that for your next transfers, it will still be beneficial thanks to our in-house monitoring system.

If you are wondering how to transfer money to India beneficially, here is a straightforward advice: stick to a service with a favourable EUR to INR exchange rate and make sure it does not charge any extra fees.

At this point, some people may argue that an international remittance service can be the best way to send money to India. Perhaps, some couriers or crypto brokers may offer you lucrative terms for transferring funds… but in this case, you should not think solely about the possible profit.

Safety

You may know that fraudsters and scammers often compromise financial services. With international remittance, finding the person responsible for the payment may be challenging if something goes wrong. When sending money with a courier, you must find someone you can trust completely. With cryptocurrency, you must become an expert to transact to India safely.

Here is how to send money to India securely: find a transfer option that is 100% legal – and have no worries about your money being delivered to your family back home!

Profee is registered as an EMI (electronic money institution), meaning that when it comes to legal issues, the company bears the same responsibility as any bank you are used to. EMIs are licensed to carry out financial operations and are regulated by the respective country's laws. Apart from that, Profee has a full-fledged security strategy: from going through regular PCI DSS certification to implementing our own solutions, we ensure that we take all the steps needed to keep Profee international transfers – and our customers' data – completely safe.

Many insist that a good old wire transfer is among the best ways to send money to India. Many international and domestic banks have solid reputations; they were established decades ago, and we simply cannot imagine any financial activities without them. Visiting a local bank and opening a debit card is one of the first steps every Indian expat takes when settling in Europe. Nevertheless, banks clearly have their disadvantages.

Speed

At times, it may be crucial to send money to India as quickly as possible. Unfortunately, a wire transfer is not the fastest way to send money to India. Banks have their own reglaments and may initiate additional checkups when it comes to cross-currency remittance. Providing the necessary details may be inconvenient and time-consuming – and if you have some issues, completing your cheap money transfer to India may take several days. Therefore, it is understandable that multiple apps helping to send money to India are gaining popularity. Many of them claim to have created the fastest way to send money to India – and indeed, the best offers for money transfers to India claim to provide speedy delivery in less than an hour. This is much faster than wire transfers or sending funds with a courier.

With Profee, your transfer speed stays fast: send money from your bank card to an account in India, and it will arrive in minutes!

There is one more thing you need to consider when choosing the best money transfer option to India: even when a transaction is fast, the process of sending money may be cumbersome.

User-friendliness

Last but not least: the best app to transfer money to India needs to be user-friendly. You may have noticed that even finding the information about the fee for your first transfer or the ‘best rates' different services offer for money transfers to India may be tricky. Even before learning how to send money to India, you may get confused about all the terms and conditions – let alone the registration and transfer processes.

At Profee, we aspire to create the best app to transfer money to India and 65+ other countries – and if you do not feel like downloading a mobile app straight away, you may try sending money with Profee at our website. You may see our transfer terms at the moment without registering – just enter the amount to be sent to see the details.

Registering at Profee and sending money to India at the best rate will only take a few minutes. We tried to simplify the process and lessened the steps you need to take to a minimum, so Profee transfers are fast and convenient. At the same time, we use advanced technologies to keep it secure. We have step-by-step guides on how to send money to India with Profee in our blog, and in case you have any questions, our customer care will be happy to assist.

Picking the best way to send money to India may be complex, as there are many factors and nuances to think over. We offer a transfer service with a beneficial exchange rate that is fast and easy yet secure. We hope you choose the money transfer service to India with a favourable EUR-INR rate which is best for you – but let us remind you that at Profee, we always welcome new customers.