As the most populated country of almost 1.5 billion people, India has the largest diaspora scattered across the world. The government is also the world’s leading remittance beneficiary, with the amount of money sent to banks in India accounting for almost 3% of its GDP. But how to send money to an Indian bank account? There are several available options, each with its pros and cons. In this article, we explore some of the popular ways to transfer money to a bank account in India from Europe.

According to the Indian Ministry of External Affairs, there are over 30 million people of Indian origin living abroad. Many of those have chosen Europe to reside and work in. Unsurprisingly, the largest Indian communities in Europe are found in Britain, the former metropolis, and Germany, the leading European economy, each hosting around 2 million people of Indian origin. The Netherlands and Italy follow with over 240,000 and 200,000 Indian residents, respectively.

Many Indians go abroad with the purpose to work and support their loved ones back home. As a result, India has been the largest recipient of international money transfers for decades. It set the record in Q4 2022 with almost $20 billion of remittances. In total, expats sending money to Indian bank accounts have managed to exceed $107 billion in 2022-2023, according to the Reserve Bank of India’s (RBI) data.

In 2020-2021 (the latest available data), the top donor European countries for India were the following:

| Source Country | Share in Total Remittances, % |

|---|---|

| United Kingdom | 6.8 |

| Germany | 0.6 |

| Italy | 0.1 |

How do people transfer money to bank accounts in India?

Due to the sheer size and diversity of the diaspora, it is safe to assume that the methods used vary greatly, from age-old cash delivered in person to modern fintech solutions such as PayPal or Profee.It’s worth noting that many factors are at play when selecting a suitable option, such as the source country, the transfer amount, and so on. Therefore, each person would have their own ‘best way’ to send money to an Indian bank account depending on their specific circumstances. Here are some of the popular ways expats use to transfer money to their loved ones.

By courier (friend)

This way of sending cash has been used since ages ago. It does, however, come with serious drawbacks. First, it is unsafe because the courier might lose the money on the way for whatever reason. Second, it is expensive due to the risks involved. Third, it is time-consuming for all the participants who need to meet in person for the cash to change hands. In today’s connected world, this method gets increasingly outdated, unable to compete with various online solutions that allow people to send money to bank accounts in India, at any time and from anywhere.

Online money transfer services

The number of providers here is growing day by day, ranging from global payment giants such as PayPal to neobanks like Revolut to niche, simple and user-friendly solutions such as Profee. Since India has established itself as a cradle for international IT talent, more and more tech-savvy Indian nationals working in Europe are using state-of-the-art fintech solutions to send money to bank accounts in India. So, how do they choose their provider? There are several factors to consider.

Sending money to Indian bank accounts online: key points to keep in mind

Before you choose your provider to send money to a bank in India, compare different options with the following in mind:

How much money you send. Some services, such as Profee, charge only a fixed fee (or none at all) regardless of the amount, which is great for larger transfers but not so much for smaller ones. Others may also deduct a percentage of what you’re sending, which might be prohibitive if your transfer is large.

How you pay for transfers. There are different payment options, and some of those might involve additional charges. For example, if you are sending money to an Indian bank account with Profee, you can pay with your bank card with no charge; at the same time, Wise charges €11.82* for a similar transfer of €1,000 to India. as of 24 July 2023

How fast you want your transfer to be delivered. Online card-to-card transfers are usually instant. However, if a bank account is involved on either side, it may take several days.

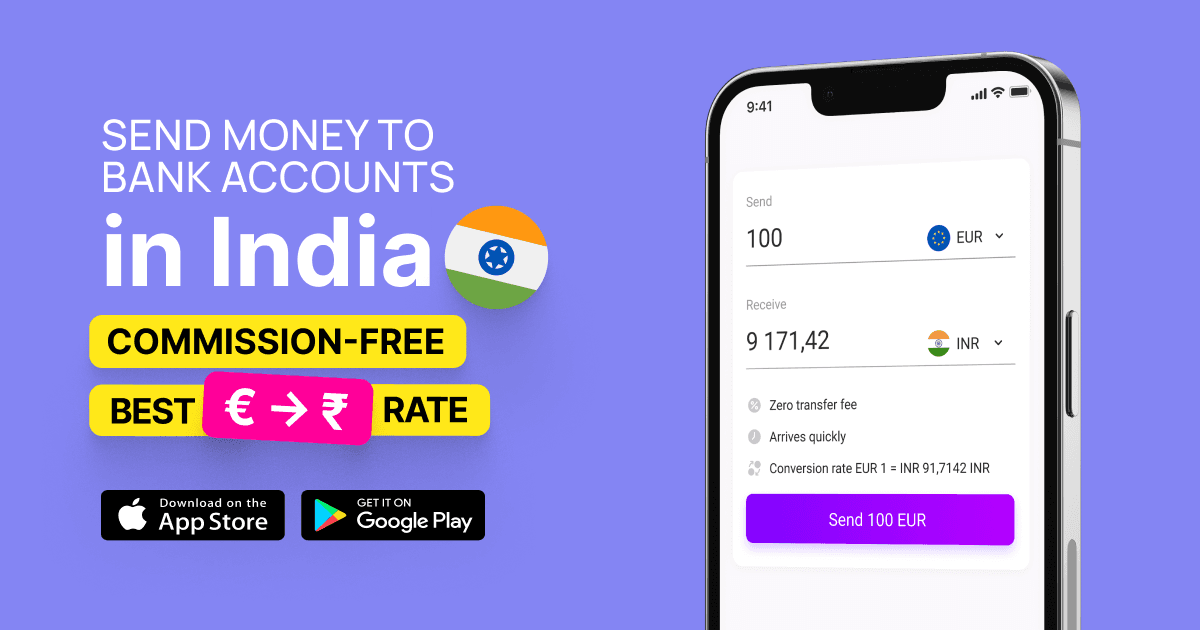

What the overall cost of the transfer is. In addition to the commission fee (fixed and/or variable), there is the conversion cost which might vary from the mid-market currency exchange rate with no markup (Wise) to markups as high as 4% and higher (PayPal, Western Union). Thanks to its state-of-the-art monitoring system, Profee offers one of the best exchange rates on the market at any given moment.

To sum up, when figuring out the best way to send money to an Indian bank account, you need to estimate the cost of transfer with different providers depending on the amount you send, the desired delivery time, the means of payment, etc. Transfer money to an Indian bank account with Profee: a step-by-step guide

Darsh Patel is a front-end developer from India who currently lives and works in Italy. His wife, Sita, is in Deli looking after their two children and her elderly parents, and Darsh regularly sends money to her bank account in India. He has already tried several online money transfer solutions and eventually settled for Profee. His reasons are: Profee offers a competitive EUR/INR conversion rate and charges no fee to transfer money to an Indian bank account. Because of his profession, he also appreciates the service’s user-friendly interface, both on the website and in the app. Below are the steps Darsh had to complete to sign up with Profee and send his first transfer.

Registration

1) Enter your phone number on www.profee.com or in the Android/iOS Profee app. Later you will receive a text message with a confirmation code.

2) Enter basic personal details such as your full name, date of birth and nationality.

3) Enter your email address. It will be used to only send you important information such as receipts.

4) Set up an 8-character password.

5) Enter the confirmation code sent to you.

6) Provide a residence address (the address of your registration in the EU). There is a convenient option to pin it on the map for the system to fill in the fields automatically.

7) Create a 4-digit passcode.

That’s it! You only need to provide this information once. Immediately after the registration, you can send up to €1,000 (you can increase this limit at any time).

How to send money to an Indian bank account with Profee

1) Enter the amount in the converter. You will be able to see how much your recipient gets in rupees and what the EUR/INR exchange rate is.

2) Enter the recipient’s details: name of the bank, IFSC code,** account number, and their full name.

An IFSC code (Indian Financial System Code) is a unique 11-digit number that indicates a particular bank branch in India. The easiest way to find it is on the chequebook provided by the bank.

3) Select the payment method. There are several options whose availability depends on various factors. For example, you can use your Google Pay or Apple Pay account if you have one. Paying via Sofort is available in some countries, including France, Germany, Italy, the Netherlands, the United Kingdom, and others.

Alternatively, you can choose to pay with your card issued by an EU bank. For your first transfer you need to provide your card’s number, expiry date, and CVV/CVC code. There is an option to securely store the card in the system to make your future transactions even faster and more convenient.

4) Once the connection with your bank/provider is established and the transfer is confirmed, the money is sent to the recipient.

As you can see, Darsh Patel has a point! Profee is a very convenient service enabling you to send money to bank accounts in India in the most efficient way and at a minimal cost. Moreover, it offers a welcome exchange rate for your first transfer to India and runs a referral programme that you and your friends can benefit from. Give it a try and use its advantages when sending money to Indian bank accounts!